Yale endowment grows 0.8 percent, its lowest since the Great Recession

The University’s annual return of $266 million was driven down by the bleak financial environment but ran ahead of figures so far released by peer institutions.

Eric Wang

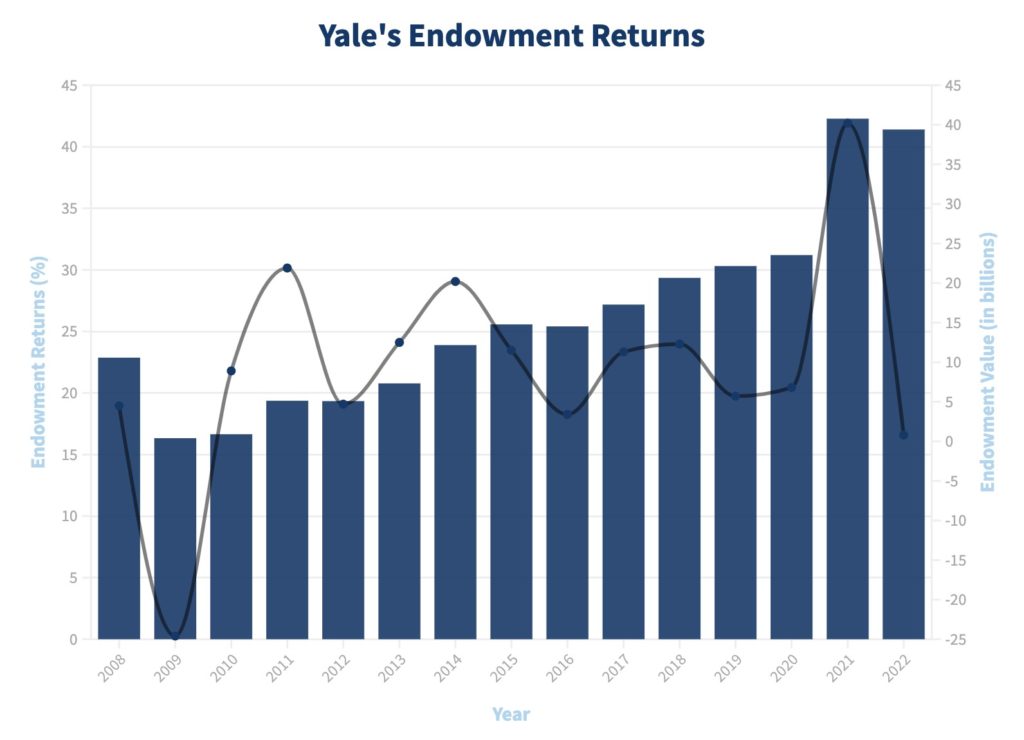

The University’s endowment grew 0.8 percent for the 2022 fiscal year, its lowest percentage return since 2009.

The annual return was slightly positive despite volatile financial markets and a declining median college endowment nationwide. Still, it represents the University’s lowest return since the Great Recession, when the endowment tanked by nearly 25 percent.

After accounting for $1.6 billion of spending distributions to the University’s operating budget, the endowment ultimately dipped to $41.4 billion for the 2022 fiscal year.

“In such a volatile year for the world’s financial markets, we are pleased to have protected Yale’s capital,” Matt Mendelsohn, Yale’s chief investment officer, said in a University press release. “That said, we expect challenging times ahead as rising interest rates, inflation and the geopolitical environment provide stiff headwinds.”

The announcement starkly contrasts last year’s, when Yale posted its highest rate of return in decades, driven in part by record-breaking venture capital gains nationwide. The staggering 40.2 percent return drove total assets to a new height of $42.3 billion, cementing Yale’s as one of the largest university endowments in the world.

Though not all of Yale’s peer institutions have released their endowment returns yet, the ones that have done so generally reported numbers lower than Yale’s.

Dartmouth’s endowment returned negative 3.4 percent, Cornell’s negative 1.3 percent and the University of Pennsylvania’s a flat 0.0 percent.

According to the press release, Yale pursues an investment strategy that balances risk and reward across multiple asset classes, including public equities, marketable alternatives, leveraged buyouts, venture capital and real assets.

The past year — Mendelsohn’s first as CIO — has strained most of Yale’s investments, and current market forecasting does not provide much optimism for the coming year.

“The outlook for next year is cloudy,” School of Management professor Jacob Thomas wrote in an email to the News. “The first three months that have gone by so far are not encouraging for the kind of assets Yale holds.”

Nevertheless it is important to consider the performance of the market and of other university endowments, Thomas told the News.

Data released by Wilshire Trust Universe Comparison Service estimates that the median college endowment fell 10.2 percent during the fiscal year ending June 30, 2022.

“It has been a challenging fiscal and calendar year for most asset classes,” Rutgers Business School professor John Longo told the News. “In this context, the performance of Yale’s endowment is quite impressive.”

Over the ten-year period ending in June 2022, Yale’s average per annum endowment return was 12.0 percent, exceeding the mean return for college and university endowments by an estimated 3.4 percent over the same period.

According to Longo, though, the appropriate comparison for Yale is not colleges and universities in aggregate. Instead, Longo said, Yale’s endowment is better compared to other large university endowments with illiquid assets and top external managers.

“Many university endowments recorded low positive returns, and several experienced negative returns for the 2022 fiscal year,” School of Management professor Geert Rouwenhorst wrote in an email to the News. “Yale invests for the long run, and it is important to take a long-term perspective.”

In the 2020 and 2021 fiscal years, Yale earned 6.8 percent and 40.2 percent, respectively. Rouwenhorst noted that, over this span, Yale’s endowment grew by more than $10 billion, even after making sizable contributions to the University budget.

The Yale Investments Office is located at 55 Whitney Avenue.